We having noticed the ratio laid down by this Court in above cases on Sections 118(a) and 139, we now summarise the principles enumerated by this Court in following manner:-

(i) Once the execution of cheque is admitted Section 139 of the Act mandates a presumption that the cheque was for the discharge of any debt or other liability.

(ii) The presumption under Section 139 is a rebuttable presumption and the onus is on the accused to raise the probable defence. The standard of proof for rebutting the presumption is that of preponderance of probabilities.

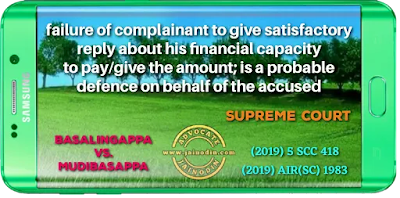

Applying the preposition of law as noted above, in facts of the present case, it is clear that signature on cheque having been admitted, a presumption shall be raised under Section 139 that cheque was issued in discharge of debt or liability. The question to be looked into is as to whether any probable defence was raised by the accused. In cross-examination of the PW1, when the specific question was put that cheque was issued in relation to loan of Rs.25,000/- taken by the accused, the PW1 said that he does not remember. PW1 in his evidence admitted that he retired in 1997 on which date he received monetary benefit of Rs. 8 lakhs, which was encashed by the complainant. It was also brought in the evidence that in the year 2010, the complainant entered into a sale agreement for which he paid an amount of Rs.4,50,000/- to Balana Gouda towards sale consideration. Payment of Rs.4,50,000/- being admitted in the year 2010 and further payment of loan of Rs.50,000/- with regard to which complaint No.119 of 2012 was filed by the complainant, copy of which complaint was also filed as Ex.D2, there was burden on the complainant to prove his financial capacity. In the year 2010-2011, as per own case of the complainant, he made payment of Rs.18 lakhs. During his cross-examination, when fina>ncial capacity to pay Rs.6 lakhs to the accused was questioned, there was no satisfactory reply given by the complainant. The evidence on record, thus, is a probable defence on behalf of the accused, which shifted the burden on the complainant to prove his financial capacity and other facts. [Para No.24]

We are of the view that when evidence was led before the Court to indicate that apart from loan of Rs.6 lakhs given to the accused, within 02 years, amount of Rs.18 lakhs have been given out by the

complainant and his financial capacity being questioned, it was incumbent on the complainant to have explained his financial capacity. Court cannot insist on a person to lead negative evidence . The observation of the High Court that trial court’s finding that the complainant failed to prove his financial capacity of lending money is perverse cannot be supported. We fail to see that how the trial court’s findings can be termed as perverse by the High Court when it was based on consideration of the evidence, which was led on behalf of the defence. This Court had occasion to consider the expression “perverse” in Gamini Bala Koteswara Rao and others Vs. State of Andhra Pradesh through Secretary, (2009) 10 SCC 636, this Court held that although High Court can reappraise the evidence and conclusions drawn by the trial court but judgment of acquittal can be interfered with only judgment is against the weight of evidence. In Paragraph No.14 following has been held:-

“14. We have considered the arguments advanced and heard the matter at great length. It is true, as contended by Mr Rao, that interference in an appeal against an acquittal recorded by the trial court should be rare and in exceptional circumstances. It is, however, well settled by now that it is open to the High Court to reappraise the evidence and conclusions drawn by the trial court but only in a case when the judgment of the trial court is stated to be perverse. The word “perverse” in terms as understood in law has been defined to mean “against the weight of evidence”. We have to see accordingly as to whether the judgment of the trial court which has been found perverse by the High Court was in fact so.”[Para No.28]

Supreme Court of India

Basalingappa

Vs.

Mudibasappa

(2019) 5 SCC 418

(2019) AIR(SC) 1983