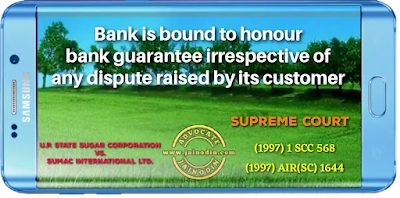

These bank guarantees which are irrevocable in nature, in terms, provide that they are payable by the guarantor to the appellant on demand without demur. They further provide that the appellant shall be the sole judge of whether and to what extent the amount has become recoverable from the respondent or whether the respondent has committed any breach of the terms and conditions of the agreement. The bank guarantees further provide that the right of the purchaser to recover from the guarantor any amount shall not be affected or suspended by reason of any disputes that may have been raised by the respondent with regard to its liability or on the ground that proceedings are pending before any Tribunal, Arbitrator or Court with regard to such dispute. The guarantor shall immediately pay the guaranteed amount to the appellant-purchasers on demand.[Para No.11]

The law relating to invocation of such bank guarantees is by now well settled. When in the course of commercial dealings an unconditional bank guarantee is given or accepted, the beneficiary is entitled to realize such a bank guarantee in terms thereof irrespective of any pending disputes. The bank giving such a guarantee is bound to honour it as per its terms irrespective of any dispute raised by its customer. The very purpose of giving such a bank guarantee would otherwise be defeated. The courts should, therefore, be slow in granting an injunction to restrain the realization of such a bank guarantee. The courts have carved out only two exceptions. A fraud in connection with such a bank guarantee would vitiate the very foundation of such a bank guarantee. Hence if there is such a fraud of which the beneficiary seeks to take advantage, he can be restrained from doing so. The second exception relates to cases where allowing the encashment of an unconditional bank guarantee would result in irretrievable harm or injustice to one of the parties concerned. Since in most cases payment of money under such a bank guarantee would adversely affect the bank and its customer at whose instance the guarantee is given, the harm or injustice contemplated under this head must be of such an exceptional and irretrievable nature as would override the terms of the guarantee and the adverse effect of such an injunction on commercial dealings in the country. The two grounds are not necessarily connected, though both may co-exist in some cases. In the case of U.P. Cooperative Federation Ltd. v. Singh Consultants and Engineers (P) Ltd. (988 [1] SCC 174), which was the case of works contract where the performance guarantee given under the contract was sought to be invoked, this Court, after referring extensively to English and Indian cases on the subject, said that the guarantee must be honoured in accordance with its terms. The bank which gives the guarantee is not concerned in the least with the relations between the supplier and the customer; nor with the question whether the suppler has performed his contractual obligation or not, nor with the question whether the supplier is in default or not. The bank must pay according to the tenor of its guarantee on demand without proof or condition. There are only two exceptions to this rule. The first exception is a case when there is a clear fraud of which the bank has notice. The fraud must be of an agregious nature such as to vitiate the entire underlying transaction. Explaining the kind of fraud that may absolve a bank from honouring its guarantee, this Court in the above case quoted with approval the observations of Sir John Donaldson, M.R. in Bolivinter Oil SA v. Chase Manhattan Bank NA (1984 [1] AER 351 at 352): "The wholly exceptional case where an injunction may be granted is where it is proved that the bank knows that any demand for payment already made or which may thereafter be made will clearly be fraudulent. But the evidence must be clear both as to the fact of fraud and as to the bank's knowledge. It would certainly not normally be sufficient that this rests on the uncorroborated statement of the customer, for irreparable damage can be done to a bank's credit in the relatively brief time which must elapse between the granting of such an injunction and an application by the bank to have it charged". This Court set aside an injunction granted by the High Court to restrain the realisation of the bank guarantee.[Para No.12]