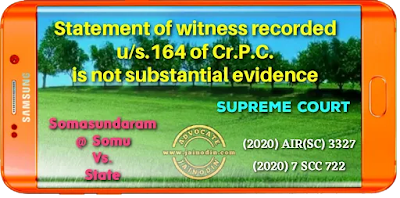

Section 164 of the CrPC , 1973 enables the recording of the statement or confession before the Magistrate. Is such statement substantive evidence? What is the purpose of recording the statement or confession under Section 164? What would be the position if the person giving the statement resiles from the same completely when he is examined as a witness? These questions are not res integra. Ordinarily, the prosecution which is conducted through the State and the police machinery would have custody of the person. Though, Section 164 does provide for safeguards to ensure that the statement or a confession is a voluntary affair it may turn out to be otherwise. We may advert to statements of law enunciated by this Court over time.[Para No.68]

As to the importance of the evidence of the statement recorded under Section 164 and as to whether it constitutes substantial evidence, we may only to advert to the following judgment, i.e., in George and others v. State of Kerala and another, AIR 1998 SC 1376:

"In making the above and similar comments the trial Court again ignored a fundamental rule of criminaljurisprudence thata statement of a witness recorded under S. 164, Cr.P.C. , cannot be used as substantive evidence and can be used only for the purpose of contradicting or corroborating him. "[Para No.69]

What is the object of recording the statement, ordinarily of witnesses under Section 164 has been expounded by this Court in R. Shaji v. State of Kerala, AIR 2013 SC 651:

"15. So far as the statement of witnesses recorded under Section 164 is concerned, the object is two fold; in the first place, to deter the witness from changing his stand by denying the contents of his previously recorded statement, and secondly, to tide over immunity from prosecution by the witness under Section 164. A proposition to the effect that if a statement of a witness is recorded under Section 164, his evidence in Court should be discarded, is not at all warranted. (Vide: Jogendra Nahak & Ors. v. State of Orissa & Ors., AIR 1999 SC 2565: (1999 AIR SCW 2736); and Assistant Collector of Central Excise, Rajamundry v. Duncan Agro Industries Ltd. & Ors., AIR 2000 SC 2901) : (2000 Air SCW 3150).