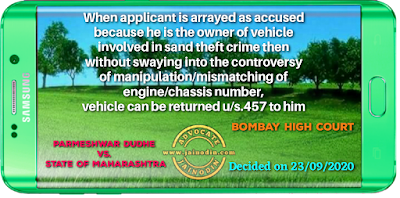

It is indeed a matter having unpleasant history. The vehicle was seized for allegedly carrying stolen sand and was intercepted and seized and admittedly since its seizure it is laying in the premises of the police station concerned. Admittedly, the applicant is being implicated being the owner of the tractor. If such is the state of affairs, in the normal course, there would not have been any difficulty in straight away handing over the vehicle to him subject to usual conditions. It is trite that the Supreme Court time and again has expressed futility in allowing detention of vehicles during the course of the trial. One can fruitfully referred to the decisions in the case of Smt. Basava and Sunderbhai (supra).[Para No.12]

However as can be discerned, the matter has become complicated because of changes in the chassis and engine numbers appearing on the tractor. The panchnama under which the tractor was seized mentions that at the time of such seizure the chassis number was appearing as "0065110367V1DH" and the engine number was appearing as "CO6014709VIDK013B". Apparently no photograph of such number as they were appearing on the chassis and engine were taken. The petitioner had applied for release of the tractor earlier to the present attempt by filing Criminal M.A. No.569/2017 but it was rejected since the numbers obviously did not tally. He preferred Criminal Revision No.220/2017. It was dismissed but a direction was given to the RTO to inspect and to register the vehicle. Pursuant to such a direction the Magistrate called upon the RTO concerned to undertake the inspection and to register the tractor since it was not registered till then with the RTO. It is apparent that the RTO thereafter undertook the inspection on 26.12.2018 (page 40) and submitted a report on the same date to the Superintendent of the Civil Court at Sillod. In addition he sent another letter dated 08.01.2019 (page 43). It was mentioned that the tractor was having chassis number and engine number which tally with the original numbers mentioned by the dealer on the Tax Invoice (Exhibit B). However, he also notice that the tractor was not in a road worthy condition and therefore for the reasons mentioned therein he was unable to register it because of various provisions contained in the Motor Vehicles Act and the Rules framed thereunder. It is in the backdrop of such state of affairs that now we are faced with the situation.[Para No.13]